Co-authored with Mark Kovarski

In an era of constant technological evolution, our utilization of different technologies, including mobile devices, has had massive impact on the financial services industry. As a result, the industry is facing major disruption as new technology translates into new ways of exchanging value (money). In fact, digital payment concepts are constantly developing, with technology advances changing the payment universe as we know it. Disruptive innovations, such as Apple Pay, continue to gain scaled acceptance globally. Contactless payment solutions could take us a step further towards getting rid of the security and convenience shortfalls of traditional credit and debit cards, but it's important that a capable, secure network is put in place before digital payments can truly flourish.

The Changing Payments Landscape

The first official currency was introduced in Turkey in 600vBC and, around 1661 AD, coins evolved into bank notes. In 1946, the first credit card was introduced and since the start of this century technology advances have disrupted the world of money more than once. In 1999, European banks started offering mobile banking while in 2008, contactless payment cards were issued in the UK for the first time. Now, driven by mobile and Internet technologies, we are in the early stages of fundamentally changing how we perceive the concept of money. Financial control is no longer only in the hands of the financial industry. Today, entrepreneurial minds are connecting us to our (and others) money in new and innovative ways.

Smartphones and tablets have recently become common devices with 79.4 million U.S. consumers who shop online. According to (source) 51% of U.S. digital buyers are expected to make purchases using a mobile device. New services like Apple Pay and mobile payments (M-payments) are becoming increasingly common in financial services. The questions we must begin to consider are, who will be the key providers in the financial services market in the future and what sort of payment ecosystem will emerge?

Traditional Banking Under Pressure

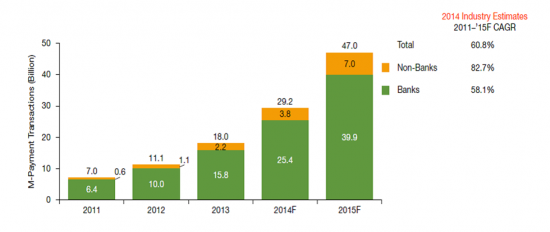

According to Capgemini's 2014 World Payments Report (WPR), M-payments transactions are expected to grow by 60.8% annually through 2015. Electronic payments (E-payments) growth will decelerate to 15.9% growth during the same period. The continued growth in volumes of E-payments and M-payments is putting pressure on all industry stakeholders to rapidly adopt these channels.

Number of Global M-Payments Transactions (Billion), 2011-2015F

Number of Global M-Payments Transactions (Billion), 2011-2015FEven with this phenomenal growth, too many banks have been sitting on the sidelines waiting to formulate a clear payments strategy and are at risk of becoming increasingly marginalized.

Firms using legacy systems in their back offices are constrained by multiple external forces and internal challenges. The main external challenge emanates from multiple regulatory and industry initiatives related to security and data privacy and a glaring lack of global standards for the exchange of value in the digital world. Other external challenges include overcapacity in the payments processing space, which has led to pressure on traditional business models and the need to find revenues from sources other than volume growth. Understanding these challenges is critical to the development of a reliable network that can enable an improved, efficient and safe fabric for the movement of money.

What Will The New World Look Like in the Virtual Currency Space?

A reliable and cost effective network is vital to success in today's payments and financial industry. The framework around the movement of value is shifting dramatically, with a greater degree of origination points and rails being run by non-financial entities which are leveraging their proprietary network and/or access to end-clients. Regulatory bodies, including the Federal Reserve System, have recognized the shift towards digital currency and have made an open call to the industry to innovate around speed, cost, and safety. At the same time, security remains a fundamental concern-while there is, with ongoing innovation in securing the entire payment stream; there is still not a 100% reliably safe, transparent and traceable infrastructure.

We've recently seen cryptocurrencies like Bitcoin become an increasingly popular method of transferring payment online. As more M-payments and new "currencies" gain popularity for transferring value in the digital economy, the design and build of a secure network tailor-made for E and M-payments will be critical. A typical approach taken today from a network security perspective around this "Internet of Money" includes system -and software -level access control. The network can detect and mitigate the risk of insiders and others that bypass the software and system access controls that are usually relied upon. The power of the network is that it is a separate parallel threat detection and management system specific to protecting company assets.

The new payments scheme will be about securely moving value (money), which requires an infrastructure (network) that drives lower costs, increases speed and improves security. Traditional and new players in the fluid model supporting the transfer of value from one entity to another will find it necessary to work towards a new framework. This ecosystem/network must emerge as one that is standards-based, secure, global and efficient on which a new digital monetary value exists and moves.

We'd like to hear from you! Tell us what you think in the comments section below:

Tags quentes :

#Segurança

rede

digital

Financial Services Industry (FSI)

digital1

digital bank

payments

Tags quentes :

#Segurança

rede

digital

Financial Services Industry (FSI)

digital1

digital bank

payments